Many of our members tell us that their dream is to own their own home and they are using our financial coaching and credit union accounts to save for a house. Saving money can be tough, especially when saving towards a bigger goal like a house deposit, car, or whatever you have planned for your next step in life.

If you’re like me, you’ll also find that saving isn’t particularly exciting. Luckily for you, we’re running through 5 different ways to save money that can make it fun!

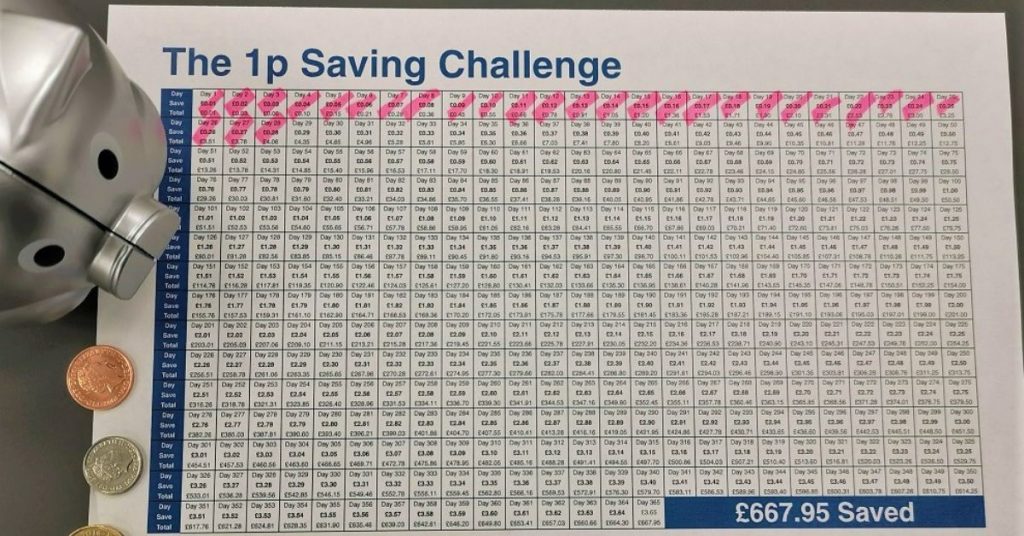

Saving challenges can be a great way to breathe fun and energy into saving, and the 1p challenge is a great example of this.

Start off by saving 1p on the first day, 2p on the second day, 3p on the third, and, well, I think you can see where we’re going with this.

As each day passes, the amount you save will increase by 1p. The great thing about this challenge is that, by saving little amounts, your savings will grow in the background and you won’t be seeing large chunks exiting your account.

After 12 months, you will have saved £667.95! Although this amount may not cover your house deposit, from just one penny it’s very impressive and is an example of one of the little things you can do to help you reach your savings goal.

Looking for a bit more excitement in your saving? The envelope challenge will keep you entertained and save you more than you might think.

To take part in this one, start by labelling 52 envelopes from 1 to 52. Each week throughout the year, select an envelope at random – you can shuffle them however you like. The number on the envelope is the amount you should save that week. Place your savings into the envelope and store it safely or, alternatively, deposit the amount in a savings account instead.

I know what you’re thinking – saving £52 in one week is hard! The beauty of this challenge is it’s flexible to your income and however much you want to save. For example, you could do this every month instead of every week, you could save more or less etc. The ball is in your court.

With 52 envelopes, you will save £1,378, which is a significant contribution towards any savings target you might have.

It is important to have a detailed budgeting plan on how you will reach your goal, especially if you are working within a timeframe. A great example of a budgeting plan is the 50/30/20 method, where 50% of your income goes towards your needs, 30% goes towards wants and 20% goes towards savings.

Needs are the essentials, like your mortgage or rent, bills, loan repayments, travel, groceries, and anything you need to live your daily life. Wants are non-essentials that you can manage without but like to spend money on, such as any subscriptions, eating out, gigs and festivals, holidays, and everything else that makes you that bit happier. Savings aren’t necessarily all towards your big target, they can also be for rainy days, unexpected expenses/bills, investing in your future, and any extra loan repayments, to name a few examples.

This budgeting method is a great framework for managing your finances and can be adjusted to your preferences to help you reach your savings target.

30-day rule

When building towards a big savings goal, it is the day-to-day habits that hold the greatest effect. It’s nice to treat yourself every now and then, but the 30-day rule simply gets us to ask ourselves one question – do we really need or want this purchase?

If you were to wait for 30 days, would you still need or want it? We can often buy things without a true need for them – trust me, we’ve all been there. You might be surprised how much you can save when resisting some shopping temptations.

The 30-day rule doesn’t mean you can’t make the purchases you want to make, it is simply there to make you question whether a purchase is worth it or whether you would rather keep building towards your long-term savings target.

Finding bargains is always useful to add more to your savings pot, so wouldn’t it be nice if we could find all the best deals in one place and be rewarded for it?

Cashback platforms, such as TopCashback, have thousands of our favourite brands in the UK, who pay to be included on their site. The money is then shared between those who sign up – you can even sign up for free.

Whether it’s your weekly shop or browsing online, make sure you’re checking for opportunities for discounts and cashback. The average member of TopCashback earns £345 a year in cashback alone. Add this to the deals you’re likely to find and you might just find your rewards building quicker than you think!

Improve your credit score

A bonus tip? You lucky people.

When saving for a house deposit you will need to keep an eye on your credit score, because, when you apply for a mortgage, lenders will consider your credit score.

There are many ways to improve your credit score to ensure you can get the best possible mortgage. If you haven’t previously borrowed money, borrowing a small amount and paying it back on time is a good place to start, whether it’s a small loan for a one-off expense or small amounts on a credit card that you can easily pay off.

If you have borrowed money before, it can be worth checking your credit report to ensure all the information has been reported correctly, so you know your score isn’t suffering due to an error out of your control.

Remember, joint accounts can affect your credit score, even if it’s not you personally who has poor credit. Talk with your partner about how both of you can work towards improving your credit scores, especially if you are working towards the same or similar savings targets.

There you have it, these are some engaging and useful methods you can use to start saving towards your first house deposit. We know it takes a lot of hard work and dedication to reach a big savings target, however with belief in yourself you will get there and you can look back proud of what you have achieved.

Looking to reach your goals? Open a Dream Saver account with us today.

Learn more about how we are all about local money for local people and helping you to achieve your goals.