Green Loan

For retrofit & sustainable changes

Borrow from £500-£15,000 from 8.8% APR

- Fair interest rates

- Affordable, flexible repayments

- No hidden charges or fees

- Quick & easy application

Looking to get going on retrofit?

We’re working with our fellow SoundPound credit unions to highlight affordable, responsible green financing options across Greater Manchester.

Get going! Apply for up to £15,000 to finance your green improvements

Make a sustainable change or retrofit today with our Green Loan

Making a green change can help you save money and energy in the longterm. Spread the cost with a Green Loan

Representative Examples

Given a fixed APR of 21.9% for Green Loans between £500 – £2,999, if you borrow £2,000 and repay £90 per month over 28 months, you will repay a total of £2,518.94.

Given a fixed APR of 14.9% for Green Loans between £3,000 – £6,999, if you borrow £5,000 and repay £165 per month over 38 months, you will repay a total of £6,205.78.

Given a fixed APR of 8.8% for Green Loans between £7,000 – £15,000, if you borrow £10,000 and repay £250 per month over 48 months, you will repay a total of £11,799.77.

We will run a credit check for your first loan with us.

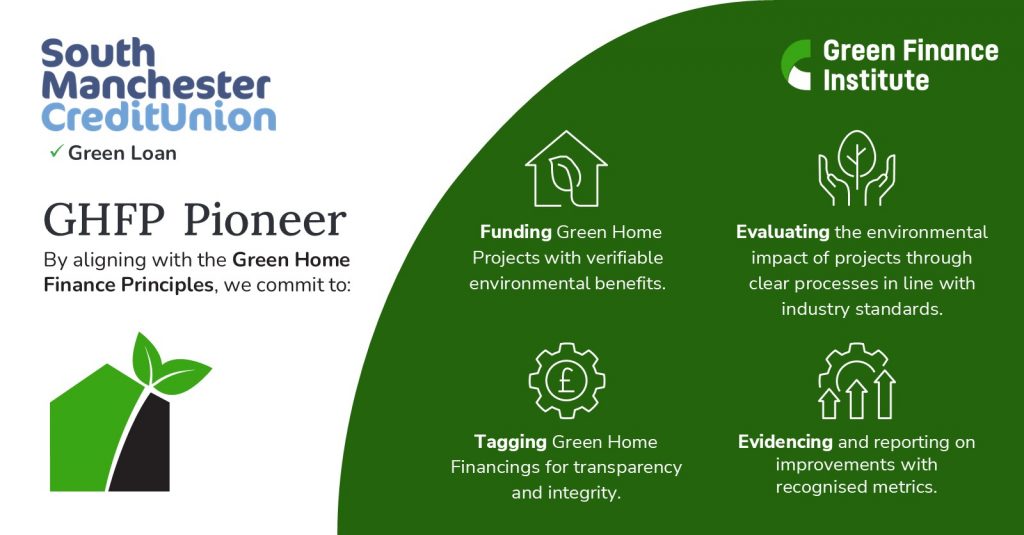

We are a Green Home Finance Principles pioneer!

How to apply

There are now two ways to apply online for your sustainable & retrofit changes

Online form

New members can use our simple online application form to apply for their first loan

All we ask for is some basic information, and we’ll be in touch within one working hour to complete your Green Loan application – it’s that easy

Mobile messaging app

All members can use our secure mobile messaging app to complete a loan application

You can complete your Green Loan application and ask us any questions all in one place – you can even talk to us about your ideas for your sustainable & retrofit changes!

Don’t worry, all messaging on our app is encrypted, so your personal documents and data are all safe and sound

Retrofitting your home – Marie’s story

Reading Time: 2 minutesDo you want to reduce your bills? Retrofitting your home and improving its energy efficiency is an effective way to achieve this. Here at South Manchester Credit Union, we can support you in reaching this goal.

What can a Green Loan be used for?

Our Green Loan can be used to buy products and services that help save energy and make any retrofit changes that can improve your sustainability and green efficiency. Here are some examples:

Keeping toasty with retrofit

Find out what benefits you could be claiming in minutes.

- Installation of energy-efficient heating controls

- Wall, attic and floor insulation

- Window and door upgrades or replacements

- Boiler upgrades and pipe insulation

- Heat pumps

Getting out and about

Information about foodbanks and affordable groceries options.

- Electric scooters

- Electric bikes

- Electric or hybrid cars

- Electric car home charger

Creating your own

United Utilities have may ways to make repayments more affordable.

- Solar Water Heaters

- Solar panels

- Rainwater harvest equipment

Why choose our Green Loan?

We lend responsibly and put people before profit!

99% of our 790+ Google reviews are 5 stars, something we are incredibly proud of. Our members show us lots of support and appreciation for the service we provide

Repay your Green Loan with flexible repayments on terms that suit you. We know everyone’s finances are different and there’s no one-size-fits-all approach, so we work with members to find the best possible way forward for your finances

Get a decision on your Green Loan within 5 working days. Speed matters and, with our experience, we are able to work quickly to get back to you with a decision and next steps

Keep your mind at ease with no fees, charges, or penalties. If you have any questions about your Green Loan, repayments, or anything to do with your account, just send us a quick message on our secure messaging app

Save whilst you repay and enjoy your savings once your Green Loan is repaid. Everyone who borrows from us saves too, so you don’t have to stress once your loan is repaid. Leave your savings here to access our lower-interest loans and continue to save, or enjoy your nest egg

Looking for something a little different?

We offer a range of loan products specifically designed to meet the needs of our members.

Looking to borrow a smaller amount? Striving for your dream goal? Want a new car? There’s a loan for everyone.

T&C's apply

We are responsible lenders and want you to stay informed. Make sure to read our loan T&C’s.

What to expect

You can apply for a loan right away! Simply fill in our online loan application form and we’ll be back in touch within 1 working hour. We’ll then finish signing you up and guide you through the application process.

Our members most often find repaying through a standing order to be easiest option. If you are employed by one of our payroll partners, your loan repayments can be taken directly from your wages through payroll deduction, so you’ll never have to see the money leave your account. If you’d prefer to call into the office, feel free to pay by cash.

Interest on all of our loans is calculated daily on the reducing balance of your loan. With every repayment you make, you clear the interest accrued since your previous repayment and your interest is then calculated for your next repayment on the reduced balance – the lower your balance, the less interest you pay.